Electric vehicle infrastructure strategy – how to scale the EV industry effectively

The number of parties involved in expanding the EV charging network is massive. It includes those that sell energy to power EV chargers, CPOs that look at payment plans and options, app developers, governments, and the carmakers themselves. All of these need to work together to support the EV ecosystem’s growth.

Growing the number of community electric vehicle charging points

One of the many benefits of EVs is that owners can charge without visiting a traditional fuel station. Either at home or the workplace, overnight, and during non-peak electrical hours where rates are typically cheaper. Currently, however, there is a 20-30% market of EV owners who are unable to charge at home or the workplace.

This problem needs to be addressed by adding electric vehicle charging points to more public parking places, malls, shopping outlets, and other easily accessible public areas. Areas that owners visit anyway, who are not going out of their way to charge. As any inconvenience may persuade buyers to not look at purchasing EVs because of their charging situation.

Investing in smart energy management

Smart systems in electric vehicle charging stations balance energy flow from renewable sources such as wind or solar. They also closely monitor EV charger usage, their safe operation of heating and cooling controls, and monitor the surrounding environment to ensure the optimum customer experience. For example, during the night, the charger may offer lighting which will switch on for easy access for the operator.

All of the above elements in a smart system are integrated on a digital platform. Namely, an electric vehicle infrastructure strategy that incorporates smart energy systems results in less downtime. This is because it’s being constantly monitored. With an advanced IoT-driven algorithm and AI, smart charging networks can autonomously optimize and monitor the safe operation of the charger. This reduces costs and energy waste from inefficient power deliveries. With nearby energy storage such as batteries, power consumption from the grid can be balanced in real-time during peak usage.

The electricity grid can talk to the EV charger in a smart energy management system, too. In essence, an analysis can take place for EV charging usage, charging time, and power delivery for making sure a charger can perform optimally when a customer begins using it. The charging network reliability is one of the major factors stopping potential owners from buying EVs.

Companies are still learning how to control the grid. Especially when rapid charger usage is growing due to their convenience and compatibility. However, over a quarter of EV chargers were not functioning correctly, according to a recent survey. Meaning they are much less reliable than originally thought. Smart energy management will be a significant way to improve the reliability of chargers if they can communicate with each other, the grid, and maintenance technicians for quick repairs.

Sustainable sourcing of lithium for EV batteries

We all know the shift in material usage when manufacturing EV batteries. Lithium is mined using a large amount of energy or water depending on how it is extracted. There is more than enough lithium that can be mined globally to cope with the demand for EVs. But the way it is mined is not sustainable.

Typically, 8 kg of lithium is required to produce one EV battery pack. Car makers are now looking at reducing this with advancements in battery chemistry. There are also new ways to mine lithium, such as extracting it from geothermal water and using geothermal energy. However, this is an uncommon method. Direct lithium extraction or recovering lithium from waste streams or low-grade ores has some potential for sustainable mining of the metal known as “white gold”.

With an increase in EV production comes an increase in battery packs already out on roads. At the end of an EVs life, the extraction of lithium can take place during the battery recycling process which opens up another way to sustainably source lithium, without extracting it from the ground. This will rapidly increase in 2030, with an estimated 54% of batteries being recycled, and it could reduce the need for extracting new lithium by around 7%.

Emphasizing second-hand EV vehicles

The idea of more production and growth for car makers helps them increase profits, share price, awareness, and branding. But this step is not in favor of original equipment manufacturers (OEMs) looking to sell more EVs. Promoting second-hand EVs helps electric vehicle charging point operators scale the demand for more charge points. It also supports the sustainable approach toward raw material extraction of lithium, nickel, and cobalt.

Governments could also step in to encourage potential owners to buy used EVs. They could also support car sharing to reduce the demand for electric vehicle charging stations. Grants or tax breaks could come in if used EVs are bought over new models, or if existing owners car-share. Either by picking up colleagues on a work commute, or renting their EVs out to others when not in use will inherently reduce demand.

More private-public investment

Frank Mühlon, President of the e-mobility division of ABB says that by integrating an electric vehicle infrastructure strategy that meets demand, an estimated $500 billion is required from public-private investment. Commercial transport that carries high loads and transports large numbers of passengers, for long distances, will be the major focus of this injection. With more investment and commitments from private organizations and governments, the EV charging strategy can meet demand sooner.

Better real-estate access and regulatory support

Emphasising the requirement of local governments is important as they have the authority to approve EV charging stations, the real estate that it is built on, and, to an extent, the power network it hooks up to. With the best talent hired to incorporate these changes, the charging network can cope with increased pressures.

According to Giovanni Palazzo in the Global Infrastructure Initiative report, main highways and dense urban areas should be the focus of EV charging networks. There should be considerations for power access for rapid charging within real estate too.

Promoting battery swapping

The charging ecosystem and overall electric vehicle infrastructure strategy doesn’t only mean introducing more chargers. It can also entail introducing battery swap stations. These are becoming more common in China, for example, with NiO having several swapping stations. The company-run facilities are automated and get you on the road in a matter of minutes. NiO promises 24,000 stations by 2025 (of the current 1,400 in place) to boost EV range anxieties.

Such an approach brings multiple advantages, including less grid demand with a slower pace of charging for packs that are being stored at the station. The battery as a service model (BaaS) means owners do not necessarily need to purchase battery packs, as they are owned by the swap station owner. If used to its full potential, a BaaS service could reduce vehicle prices for drivers.

However, since every car maker now produces their own battery pack designs, it is difficult to include all of them in a battery swap station. The difficult solution would be introducing a modular battery design for all EVs, broken down into 2,3 or 4kW packs, meaning more modules can be replaced for larger vehicles when required.

Building the right EV charging strategy

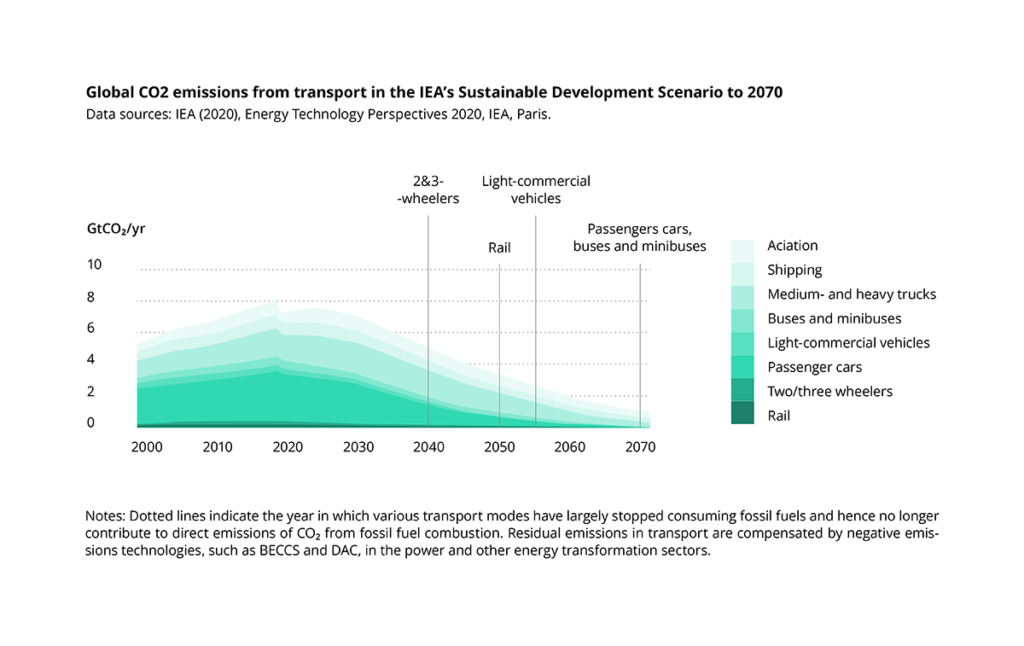

The need for an electric vehicle infrastructure strategy is vital, given the government bans on combustion vehicles and net zero emission pledges by 2050. There are many ways of coping with the increased amount of EVs on the road, including collaborating with governments to ease regulations, reducing reliance on rare materials, and sourcing them sustainably. All this while also putting an emphasis on second-hand EV sales can all tackle the EV charging ecosystem.

We have encountered this problem before, when gas fuelled vehicles became the norm. With huge investments from multiple industries, electric vehicle charging stations can be installed at a rapid rate. As long as smart technologies are used to integrate them into the grid, using enhanced power management and better reliability, there is a bright future for the EV revolution.